Browsing Cases: Why You Required a Proficient Disaster Adjuster in your corner

In the after-effects of a disaster, browsing the complexities of insurance claims can come to be an overwhelming job, often aggravated by the emotional toll of the occasion itself. A skilled disaster insurer is not merely an advocate but a vital partner in making sure that your claims are evaluated accurately and relatively.

Comprehending Catastrophe Adjusters

Disaster adjusters play a crucial function in the insurance coverage industry, especially in the aftermath of significant disasters. These specialists specialize in handling claims associated with large-scale occasions such as wildfires, cyclones, and earthquakes, which typically cause widespread damages. Their proficiency is crucial for efficiently making sure and analyzing losses that policyholders get reasonable compensation for their insurance claims.

The key responsibility of a disaster insurer is to evaluate the degree of damages to residential properties, vehicles, and other insured possessions. This entails conducting extensive examinations, collecting documentation, and working together with different stakeholders, consisting of insurance holders, contractors, and insurance firms. In many cases, catastrophe insurance adjusters are released to impacted locations soon after a catastrophe strikes, permitting them to give prompt assistance and expedite the claims process.

Additionally, catastrophe insurance adjusters need to have a deep understanding of insurance policies and policies to precisely translate protection terms and conditions. Their logical abilities and focus to detail are vital in figuring out the authenticity of insurance claims and determining any type of prospective fraud. By browsing the complexities of disaster-related claims, catastrophe insurers play an indispensable duty in recovering the economic stability of affected people and neighborhoods.

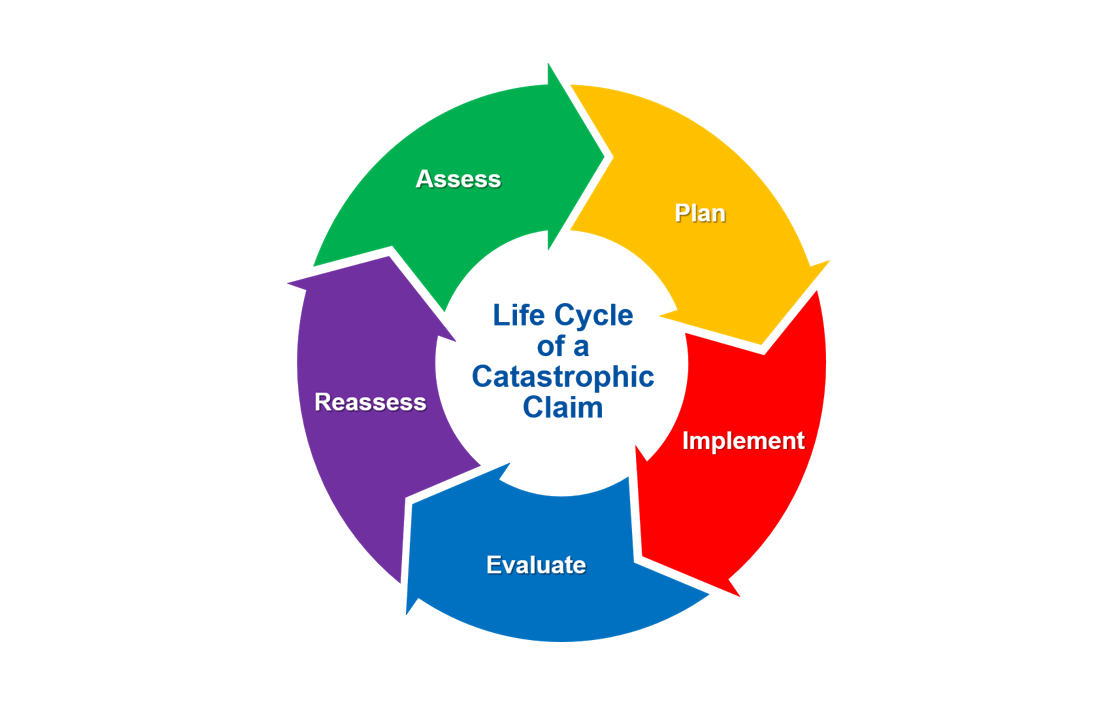

The Claims Refine Discussed

When a calamity strikes, recognizing the insurance claims procedure is necessary for insurance holders looking for settlement for their losses. This procedure normally begins with notifying your insurance policy firm concerning the occurrence, offering them with information such as the day, time, and nature of the damage. Following this preliminary report, an insurer will be appointed to evaluate your claim, which includes examining the loss and determining the level of the damage.

Documents is an important part of the claims procedure. Insurance holders should gather proof, including photos, invoices, and any type of various other important info that supports their insurance claim. As soon as the adjuster has actually conducted their assessment, they will submit a record to the insurer. This record will certainly describe their searchings for and supply a recommendation for payment based upon the insurance policy holder's insurance coverage.

After the insurance provider assesses the insurance adjuster's report, they will certainly choose pertaining to the insurance claim. The insurance holder will get settlement based on the terms of their plan if accepted. Need to there be any type of denials or disagreements, additionally settlements might occur, potentially calling for extra paperwork or reevaluation of the insurance claim. Understanding these actions can dramatically help in browsing the intricacies of the insurance claims procedure.

Benefits of Employing an Adjuster

Hiring an insurer can supply countless advantages for insurance holders navigating the insurance claims procedure after a calamity. One of the key advantages is the proficiency that a skilled catastrophe insurance adjuster brings to the table. They possess in-depth knowledge of insurance plan and claim treatments, enabling them to precisely examine problems and supporter effectively for the insurance policy holder's interests.

Furthermore, an adjuster can alleviate the stress and complexity connected with suing. They take care of communications with the insurance policy business, making sure that all required documents is submitted without delay and correctly. This degree of organization assists to speed up the insurance claims procedure, minimizing the moment policyholders should await settlement.

In addition, insurers are adept at working out settlements. Their experience permits them to recognize all possible damages and losses, which may not be quickly noticeable to the insurance policy holder. This detailed evaluation can result in an extra desirable negotiation quantity, ensuring that the insurance holder obtains a reasonable evaluation of their insurance claim.

Picking the Right Adjuster

Picking the ideal insurer is important for making sure a smooth insurance claims process after a calamity. When faced with the after-effects of a tragic occasion, it is important to select an adjuster who has the appropriate qualifications, experience, and regional expertise. A skilled catastrophe insurer ought to have a solid record of handling comparable cases and be well-versed in the intricacies of your particular insurance coverage plan.

As soon as you have a shortlist, conduct interviews to gauge their communication skills, responsiveness, and desire to advocate for your passions. Find Out More An experienced adjuster ought to be go right here transparent concerning the claims process and give a clear overview of their fees. Finally, depend on your impulses-- pick an adjuster with whom you feel positive and comfortable, as this partnership can considerably influence the end result of your claim.

Common Misconceptions Exposed

Misunderstandings regarding catastrophe adjusters can lead to complication and impede the claims process. One typical myth is that catastrophe insurance adjusters function exclusively for insurance provider. In truth, numerous insurers are independent professionals that support for insurance holders, making certain fair assessments and negotiations.

One more misunderstanding is that working with a catastrophe insurance adjuster is an unnecessary expenditure. While it holds true that insurance adjusters bill fees, their know-how can frequently cause greater claim settlements that much outweigh their costs, ultimately benefiting the insurance holder.

Some people think that all claims will be paid in full, regardless of the circumstance. Insurance plans usually include certain terms and conditions that might limit coverage. Comprehending these subtleties is vital, and a proficient adjuster can aid navigate this complexity.

Verdict

In summary, the involvement of a proficient catastrophe adjuster dramatically improves the insurance claims process adhering to a disaster. Ultimately, the decision to engage a disaster insurer can have an extensive influence on the end result of insurance policy cases.

In lots of cases, catastrophe insurance adjusters look at this site are released to influenced areas shortly after a disaster strikes, enabling them to provide timely assistance and speed up the insurance claims procedure. - insurance claims recovery

A knowledgeable catastrophe insurance adjuster ought to have a strong track record of handling similar claims and be fluent in the intricacies of your particular insurance plan.

Begin by looking into prospective insurers, looking for expert classifications such as Licensed Insurer or Accredited Claims Insurance Adjuster. catastrophic claims adjuster.Misconceptions about disaster adjusters can lead to complication and prevent the insurance claims procedure.In recap, the participation of a skilled catastrophe insurance adjuster considerably boosts the claims procedure adhering to a catastrophe